Law Office Insurance

Safeguard Your Practice: Insurance Every Law Office Needs

Owning a law office requires more than simply managing daily operations. It’s about safeguarding the reputation you have worked diligently to establish and ensuring your clients’ trust remains strong. Comprehensive insurance coverage is not just a formality; it serves as the foundation that allows you to focus on serving your clients, confident that your practice is properly protected.

What insurance does a law office need?

The right insurance coverage is essential for law firms of any size, ensuring you are prepared for the unexpected.

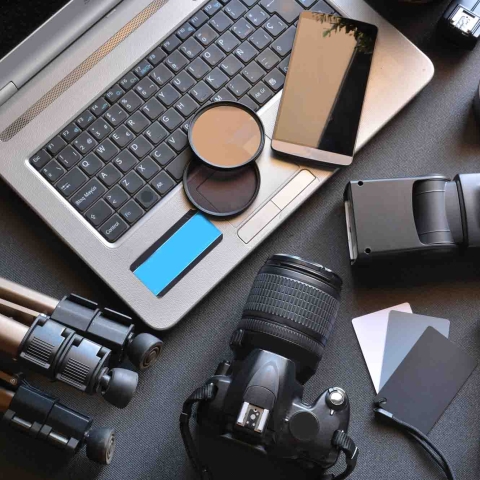

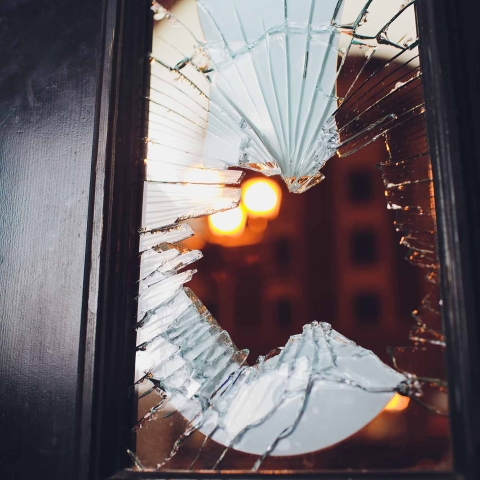

- Property Insurance: Helps cover your office space, furnishings, computers, files, and essential casework against losses from fire, theft, water damage, or other incidents.

- General Liability Insurance: Helps provide protection if a client, vendor, or visitor is injured at your office, covering medical expenses and legal costs.

- Workers Compensation Insurance: Required for law offices with employees, offering support for workplace injuries or illnesses and helping you meet legal requirements.

- Cyber Liability Insurance: Helps shield your law firm from financial loss due to data breaches, cyberattacks, or compromise of sensitive client information, critical in today’s digital environment.

How to get law office insurance?

Contact a local Indiana Farmers Insurance agent today for a comprehensive coverage review and quote and help protect what matters most to you.

When you partner with Indiana Farmers Insurance and our local independent agents, you benefit from tailored small business insurance solutions and dedicated local service. Our commitment to member-first service allows you to build lasting client relationships with confidence that your business is protected.

The information presented in this document is for informational and educational purposes only. It is intended to assist individuals, farmers, and business owners in identifying common hazards/risks and considering proactive loss prevention or loss mitigation actions. For information related to specific loss hazards or questions regarding specific policy coverage, please contact your insurance agent.