Accounting Firm Insurance

How Insurance Builds Trust and Protects Your Accounting Business

Operating a successful accounting firm requires an approach to risk management that extends beyond maintaining accurate financial records. Implementing the right insurance coverage is essential for safeguarding your business and sustaining the professional trust established with your clients.

What insurance does an accounting firm need?

Accounting firms need comprehensive insurance coverage to manage risks, protect business operations, and maintain client trust. Here are some key insurance types every accounting practice should consider:

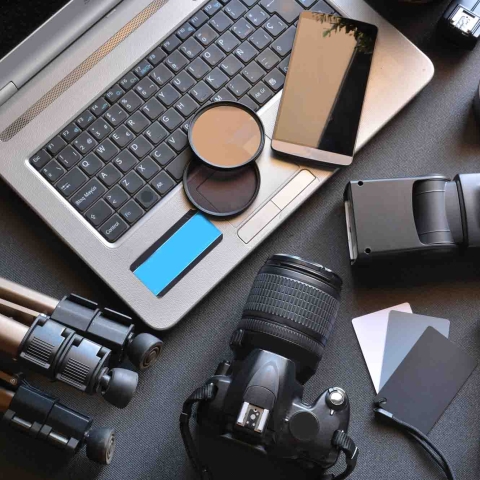

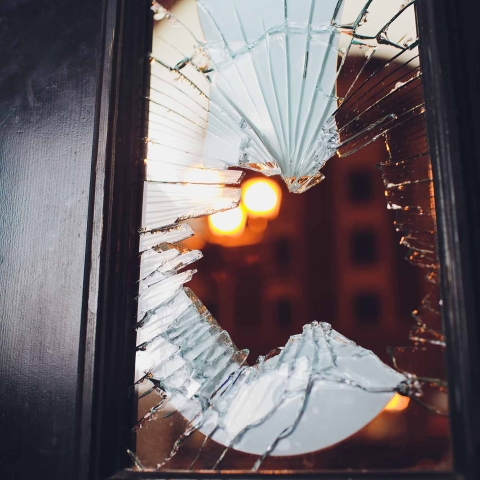

- Property Insurance: Helps cover your office, computers, records, and specialized equipment against risks like fire, theft, or water damage, ensuring minimal disruption to your operations.

- General Liability Insurance: Helps provide protection if a client or visitor is injured at your office, adding an extra layer of security to your practice.

- Workers Compensation Insurance: Required for firms with employees, this coverage addresses workplace injuries, supports staff well-being, and ensures compliance with legal requirements.

- Cyber Liability Insurance: Helps shield your practice from costs related to data breaches, cyberattacks, and loss of sensitive client information, vital as accounting firms increasingly rely on digital records and communication.

How to get accounting firm insurance?

Contact a local Indiana Farmers Insurance agent today for a comprehensive coverage review and quote and help protect what matters most to you.

When you partner with Indiana Farmers Insurance and our local independent agents, you benefit from tailored small business insurance solutions and dedicated local service. Our commitment to member-first service allows you to build lasting client relationships with full confidence that your business is protected.

The information presented in this document is for informational and educational purposes only. It is intended to assist individuals, farmers, and business owners in identifying common hazards/risks and considering proactive loss prevention or loss mitigation actions. For information related to specific loss hazards or questions regarding specific policy coverage, please contact your insurance agent.