Bakery Insurance

Essential Insurance Every Bakery Needs

Owning a bakery is your dream, your passion, and each day you put your heart into every roll, cookie, and cupcake. While you’re busy creating treats that bring a smile to your customers’ faces, it can be easy to forget about the “what-ifs.” But making sure your bakery is prepared for the unexpected is one of the best recipes for peace of mind.

What insurance does a bakery need?

Bakery owners need comprehensive insurance to safeguard their property, employees, and operations. Essential bakery insurance includes:

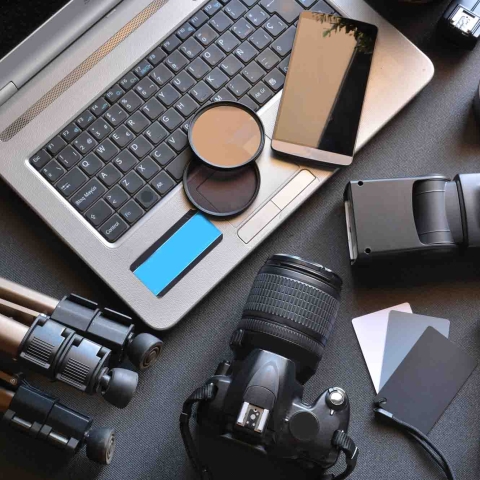

- Property Insurance: Helps protect ovens, mixers, display cases, ingredients, and finished goods from damage, spoilage, equipment breakdown, or supply chain issues.

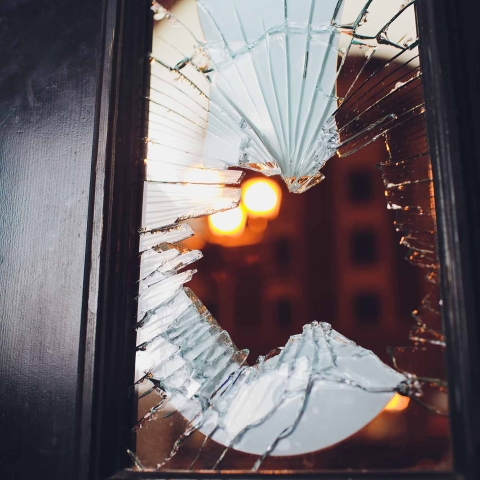

- General Liability Insurance: Helps cover costs if a customer suffers an injury or accident on bakery premises.

- Product Liability Insurance: Helps protect your bakery if your baked goods cause illness or harm to a customer.

- Business Interruption Insurance: Helps provide income protection if you must temporarily close your bakery due to fire or equipment failure.

- Workers Compensation Insurance: Covers medical costs and lost wages if an employee is injured while working at the bakery.

- Cyber Liability Insurance: Helps protect your bakery from losses if online customer orders or personal data are compromised in a cyberattack.

How to get bakery insurance?

Contact an Indiana Farmers Insurance agent for a personalized bakery insurance quote and ensure your business is protected.

When you partner with Indiana Farmers Insurance and our local independent agents, you benefit from tailored small business insurance solutions and dedicated local service. Our commitment to member-first service allows you to build lasting customer relationships with confidence that your business is protected.

The information presented in this document is for informational and educational purposes only. It is intended to assist individuals, farmers, and business owners in identifying common hazards/risks and considering proactive loss prevention or loss mitigation actions. For information related to specific loss hazards or questions regarding specific policy coverage, please contact your insurance agent.