Bookstore Insurance

Protect Your Story: Insurance for Bookstore Owners

Owning a bookstore is a special kind of adventure as every shelf you stock and customer you greet helps create a welcoming spot for book lovers in your community. But running a bookstore also means making sure what you’ve worked so hard to build stays safe. That’s where reliable insurance can make all the difference.

What insurance does a bookstore need?

Running a bookstore involves unique risks, so business owners should consider specialized insurance to protect their property, customers, and operations, including:

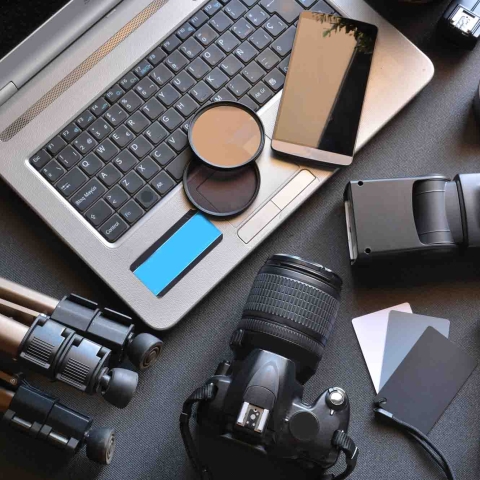

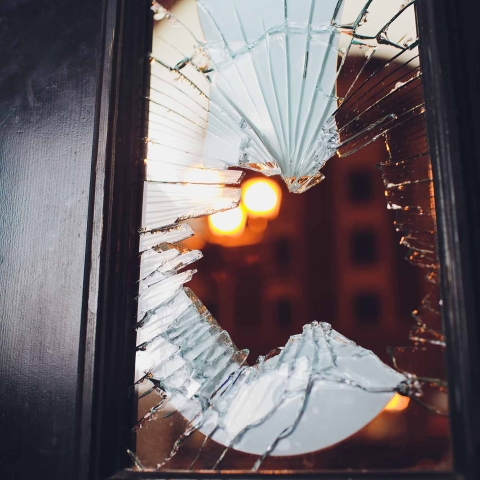

- Property Insurance: Helps protect your inventory, furniture, custom shelves, reading areas, and technology, such as point-of-sale systems, against damage from events like fire, water leaks, or theft.

- General Liability Insurance: Helps cover costs if a customer is injured in your store, such as from slips and falls, helping with medical bills and protecting your business reputation.

- Business Interruption Insurance: Helps provide financial support if you must close temporarily due to unexpected events, covering lost income and ongoing expenses.

- Workers Compensation Insurance: Ensures your employees are protected if they experience a workplace injury while helping customers or handling books.

- Cyber Liability Insurance: Helps safeguard your business from losses related to data breaches or cyberattacks, especially if you process online orders or store customer information.

How to get bookstore insurance?

Contact a local Indiana Farmers Insurance agent today for a quote for your bookstore and help protect what matters most to you.

When you partner with Indiana Farmers Insurance and our local independent agents, you benefit from tailored small business insurance solutions and dedicated local service. Our commitment to member-first service allows you to build lasting customer relationships with confidence that your business is protected.

The information presented in this document is for informational and educational purposes only. It is intended to assist individuals, farmers, and business owners in identifying common hazards/risks and considering proactive loss prevention or loss mitigation actions. For information related to specific loss hazards or questions regarding specific policy coverage, please contact your insurance agent.