7 Reasons to Report Your Small Business Claim As Soon As Possible

Business

Report Your Claim Quickly for the Best Results

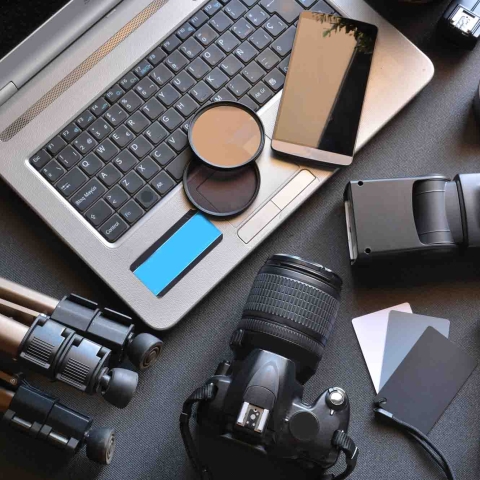

As a small business owner, reporting a claim promptly is not just important, it is crucial. This not only ensures that your business can get back on track quickly but also helps maintain a positive reputation among your customers.

Reporting a claim quickly as a small business owner is essential for several important reasons:

- It stands to reason that the sooner you report the claim, the quicker you will receive your claim payment. By promptly reporting the claim, you enable the insurance company to kickstart the claims process, leading to more timely reimbursement of any covered expenses or damages.

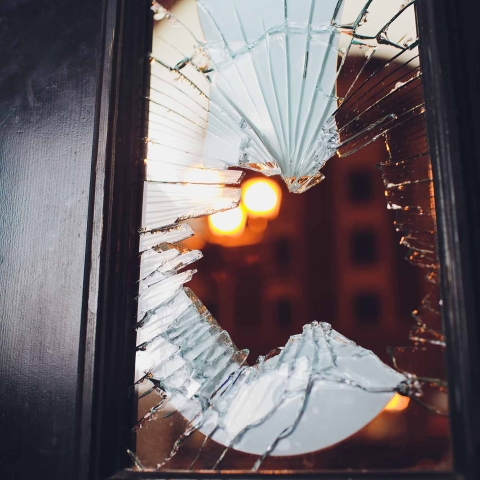

- Timely reporting can also help prevent additional damages or losses from occurring. For example, a tree falls on your building, reporting it quickly can facilitate repairs, minimizing the risk of additional deterioration or harm.

- The details of an incident are fresher in your memory when you report it soon after it occurs. This can lead to more accurate and detailed information in your claim report, which can be crucial for claim assessment.

- Reporting a claim promptly allows for better preservation of evidence. The sooner you file a claim, the easier it is to document the situation, gather witness statements, and collect any necessary photographs or documentation to support your claim.

- Let's not overlook the importance of compliance. An insurance policy is a contract and contains certain stipulations. In fact, many insurance policies typically have specific requirements for reporting claims. Failing to report a claim within the stipulated time frame could potentially result in your claim being denied or delayed.

- Certain claims, such as liability claims or workers' compensation incidents, can have implications on your business operations. Reporting these claims quickly can help you manage these disruptions effectively and potentially prevent legal complications.

- Knowing that you've taken the necessary steps to report a claim promptly can provide peace of mind during what can be a stressful situation. It sets the wheels in motion for the resolution process, allowing you to focus on running your business.

Remember to review your insurance policy to understand the specific requirements for reporting claims. Different types of claims and insurance policies may have varying reporting timelines, so it's important to be aware of these details to ensure a smooth claims process.

Resources

Business

Business

Business

Auto

Home

Farm

Business

Business

Auto

Home

Farm

Business

Business

Business

Business

Farm

Business

Farm

Business